Norsk Hydro ASA and Orkla ASA have agreed to combine their respective profiles, building systems and tubing business, creating the world's leading aluminium solutions provider. The new combined company, to be named Sapa, will be a 50/50 joint venture owned by Hydro and Orkla.

The agreement covers Profiles and Building System, as well as Extruded and Welded tubes, of Orkla's fully-owned Sapa and all of Hydro's Extruded Products business area.

Based on 2011 figures, the combined company will have around NOK 47 billion in annual revenues, underlying EBITDA of around 1.9 billion and approximately 25,000 employees.* The new company will have leading positions in Europe and North America, and strong footholds in emerging markets, including Brazil, Argentina, China, India and Vietnam.

Completion of the transaction is expected to take place in the first half of 2013, following approvals from relevant competition authorities. Svein Tore Holsether, currently President and CEO of Sapa, will be President and CEO, and Arnstein Sletmoe, currently Senior Vice President and Head of Mergers & Acquisitions in Hydro, will be appointed CFO of the merged company. President and CEO of Hydro, Svein Richard Brandtzæg, will be the chairman of the company. Sapa will have its headquarter in Oslo, Norway

"Together we are creating a stronger company with a broader competence base and a highly experienced management team. In today's very challenging market conditions, the combined company will be better positioned for restructuring and value creation. This will strengthen Orkla's ability to successfully capture the value potential of our aluminium business," says Orkla's President and CEO Åge Korsvold.

"The new company will have the necessary strength to meet current challenging markets and create a platform for future growth in emerging markets," says Hydro's President and CEO Svein Richard Brandtzæg. "This transaction will contribute to strengthening Hydro as a world-leading, resource-rich aluminium company with robust activities across the value chain. Through the combination with Sapa, Hydro is establishing a new structure for its extrusion business positioned for improved profitability and potential for future growth," he says.

As part of the agreement, Hydro (through Hydro Aluminium AS) and Orkla (through Sapa Holding AB) will contribute their relevant businesses to the new company in return for shares on a 50/50 basis. To compensate for the difference in size and to harmonize certain balance sheet items, Orkla will, in addition to its 50 percent ownership, receive the amount of NOK 1.8 billion from the new company. The amount is expected to be paid within 6 months of completion.

Significant improvement efforts are ongoing in both entities and will, together with assumed annual synergies of around NOK 1 billion, contribute to further strengthening the new company. On a global basis, demand for extruded aluminium applications is expected to continue its strong underlying growth.

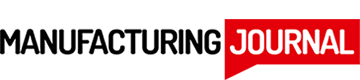

"Aluminium is the material of the future. To meet customers' high demands, we need to continue to excel in R&D, deliver with precision and optimize our global footprint. Both entities have demonstrated their ability to increase quality and efficiency, and together we are determined to bring out the best of the two companies into one," says Svein Tore Holsether, President and CEO of Sapa.

The agreement contains provisions whereby either party may initiate an initial public offering (IPO) process after approximately three years from closing, and where each party can decide to retain 34 percent.

The new joint venture will be presented as an associated company according to the equity method.