The EU Commission has approved today the transaction between Norwegian aluminium company Norsk Hydro ASA and branded consumer goods group Orkla ASA to form a 50/50 joint venture within aluminium solutions to be named Sapa. Pending necessary approval from Chinese competition authorities, the parties expect the transaction to be completed in third quarter 2013, at the latest.

The transaction has already been approved by the U.S. Department of Justice and relevant competition authorities in several other jurisdictions. The parties also need approval from Chinese competition authorities (MOFCOM), which is currently evaluating the transaction.

Due to limited overlap of the parties' operations in China, the parties expect the transaction to be approved. The timing of the approval from MOFCOM is difficult to determine, but the parties expect the transaction to be approved in the third quarter, at the latest.

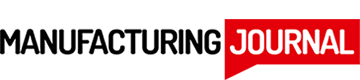

Approval from the EU Commission is conditioned on the sale of Hydro's aluminium profile operations at Raufoss in Norway and its affiliated fabrication plant in Vetlanda in Sweden, as well as Sapa's multi-port extrusion (MPE) operations in Harderwijk in the Netherlands. The parties have started the process to divest these businesses in line with the Commission's decision.

From June 1 and until closing, Arnstein Sletmoe, who has been appointed CFO of the new Sapa joint venture, will temporarily head up Hydro's Extruded Products business area. At the same time, Executive Vice President Hans Joachim Kock, currently head of Extruded Products, will take over as Head of Finance in the Bauxite & Alumina business area and leave the Corporate Management Board (CMB), as previously announced. Sletmoe will report directly to CEO Svein Richard Brandtzæg, but will not be part of the CMB.

Certain statements included within this announcement contain forward-looking information, including, without limitation, those relating to (a) forecasts, projections and estimates, (b) statements of management's plans, objectives and strategies for Hydro, such as planned expansions, investments or other projects, (c) targeted production volumes and costs, capacities or rates, start up costs, cost reductions and profit objectives, (d) various expectations about future developments in Hydro's markets, particularly prices, supply and demand and competition, (e) results of operations, (f) margins, (g) growth rates, (h) risk management, as well as (i) statements preceded by "expected", "scheduled", "targeted", "planned", "proposed", "intended" or similar statements.

Although we believe that the expectations reflected in such forward-looking statements are reasonable, these forward-looking statements are based on a number of assumptions and forecasts that, by their nature, involve risk and uncertainty. Various factors could cause our actual results to differ materially from those projected in a forward-looking statement or affect the extent to

which a particular projection is realized. Factors that could cause these differences include, but are not limited to: our continued ability to reposition and restructure our upstream and downstream aluminium business; changes in availability and cost of energy and raw materials; global supply and demand for aluminium and aluminium products; world economic growth, including rates of inflation and industrial production; changes in the relative value of currencies and the value of commodity contracts; trends in Hydro's key markets and competition; and legislative, regulatory and political factors.

No assurance can be given that such expectations will prove to have been correct. Hydro disclaims any obligation to update or revise any forward looking statements, whether as a result of new information, future events or otherwise.

This information is subject of the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.